Technology has been a catalyst of change for today’s consumer. Customer preferences are being reshaped, as organizations now compete with the expectations set by innovative new companies and incumbents alike for seamless, tailored experiences. Banking is no exception.

For more than 20 years, the financial services sector has been continually adapting and looking for ways to create digitally-driven experiences for customers—from digital banking to underlying new capabilities like artificial intelligence and APIs. We see a need and opportunity to shift to a model that puts the customer in full control.

Retail banking’s future state

The future state for retail banking customers embraces digital interaction and allows customers to move seamlessly among distribution channels and digital properties. Customers are increasingly experiencing their relationship with their bank in places that don’t always require them to come into a branch or visit an ATM or even a website. Instead, banks will be found where customers are spending their digital time.

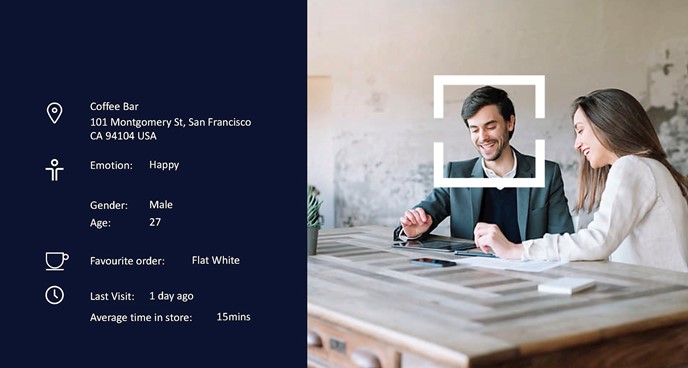

The model is open banking—the sharing of personal financial transaction data between organizations (with the customer’s consent)—and it has benefits for customers and the companies that serve them. Open banking will lead to greater personalization; financial services institutions can start to interact with customers in ways that extend beyond just financing by bringing together different sources of data.

Open banking will also give customers the ability to provide visibility (that is anonymized) to some of their financial data when applying for certain products to help them with choosing the right product and removing friction from the application process.

The home buying process is a great example of how the experience will change to empower the customer. With open banking, customers will engage with their banks holistically across the journey. There are three phases of the process where a customer is going to see the most value: when they are just starting out and thinking about buying, when they are looking to buy, and after they have moved in.

Instead of just being able to offer a mortgage, a bank can offer the entire value chain. Before a customer applies for a mortgage, the bank could act as a trusted advisor and help a client understand personal finances and connect them to mortgage brokers. As the buyer gets closer to purchasing, the bank could introduce a series of partners like realtors, lawyers, insurance companies, and movers.

The unique value proposition, as we see it, is that open banking provides new ways to put customers at the center of what we do and engage with them when they’re thinking about important financial decisions, regardless of where they’re spending their digital time. In a broader open banking system, we’ll have the opportunity to use new data to create enriched experiences and new services that meet their evolving needs.

In the coming years, we can expect to see a shift in the retail banking landscape. But it’s a shift that will greatly benefit both consumers and institutions. With an open banking model, the platform stands to benefit customers by allowing them to tap into end-to-end solutions specifically tailored for them. Banks stand to benefit too, as the model allows for greater innovation potential

Brett Pitts, BMO